Dynamic Pricing Strategies using Reinforcement Learning and Market Microstructure Analysis

Pricing strategies are a key factor in determining a company’s income and profitability in the fast-paced commercial world of today. Because it can adjust to shifting market conditions, dynamic pricing in particular has drawn a lot of interest lately. The use of cutting-edge methods like Market Microstructure Analysis and Reinforcement Learning in dynamic pricing strategies is examined in this blog article.

Market Microstructure Analysis

CHAPTER 1

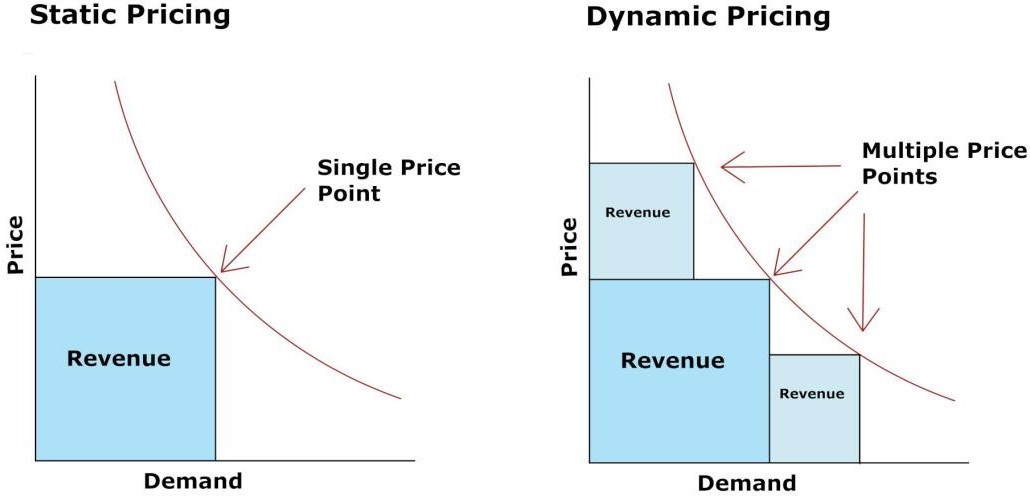

1.1 Introduction to Dynamic Pricing

Dynamic pricing is a flexible pricing technique that involves real- time price adjustments in response to shifting supply, demand, and market conditions. Businesses can maximize income, optimize pricing tactics, and maintain market competitiveness with this method. The difficulty of figuring out the best prices for goods or services in a market that is uncertain and ever-changing is known as a dynamic pricing problem. The demand for a good or service is frequently unpredictable in this situation. Factors such as shifting customer behaviour, outside events, or market trends can all affect demand. At the moment, the majority of dynamic pricing systems necessitate complete understanding of customer-side data. Over the past few years, researchers have gathered information on a number of issues, including minimizing parking costs, increasing revenue, managing and reducing clogged roads. This presumption facilitates the reduction of intricate real-world situations to manageable models. Machine learning models can be trained on previous data to discover patterns and relationships if the issue properties change.

Fig 1.1 Dynamic Pricing

- E-commerce: Dynamic pricing helps online retailers adjust prices based on competitor pricing, customer behaviour, and inventory levels.

- Hospitality: Hotels and airlines use dynamic pricing to adjust room rates and ticket prices based on demand, occupancy, and seasonal fluctuations.

- Transportation: Ride-hailing companies like Uber and Lyft employ dynamic pricing to adjust fares based on demand, traffic, and time of day.

- Energy and Utilities: Dynamic pricing helps energy companies adjust prices based on demand, supply, and weather conditions.

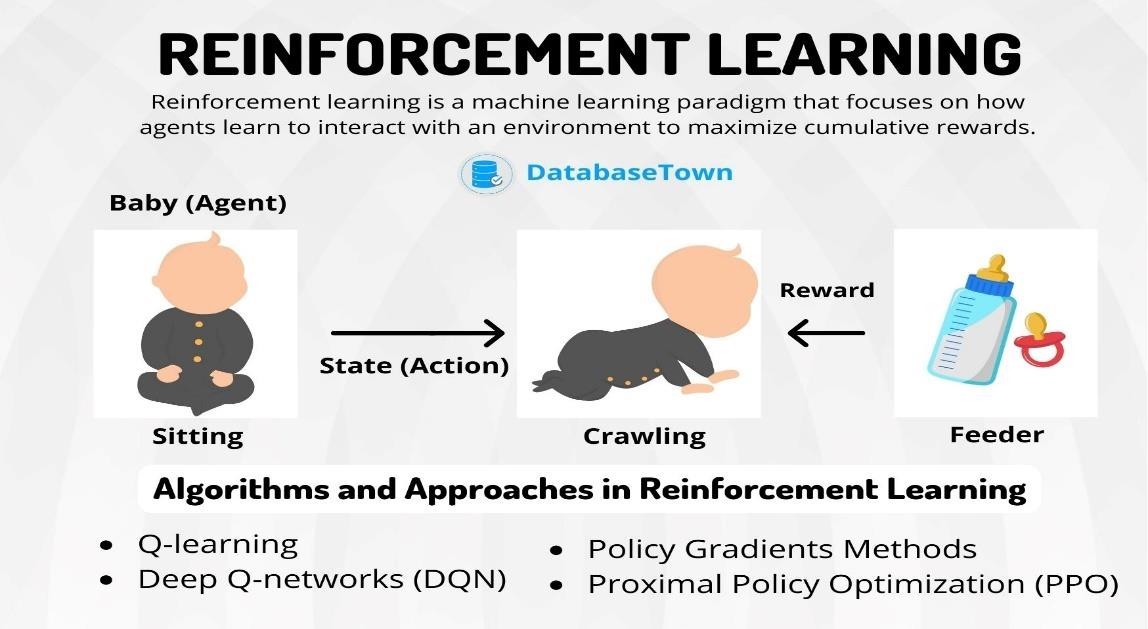

1.2 Reinforcement Learning for Dynamic Pricing

A branch of machine learning called reinforcement learning (RL) focuses on teaching agents to make choices in challenging, unpredictable situations. Because RL can learn from interactions with the environment and adjust to changing situations, it is especially well- suited for dynamic pricing optimization.

Fig 1.2 Basics of Reinforcement Learning

Understanding Market Dynamics:

- Order flow and liquidity: Businesses can better understand how market participants interact and affect prices by analysing order flow and liquidity.

- Market microstructure analysis shows how prices are found and modified in reaction to shifts in supply and demand.

Understanding Customer Behaviour:

- Demand and supply: Businesses can better understand the dynamics of supply and demand and modify their pricing strategies by analysing market microstructure.

- Consumer preferences: Businesses can determine consumer preferences and modify their product offerings and marketing methods to suit consumer demands by looking at market

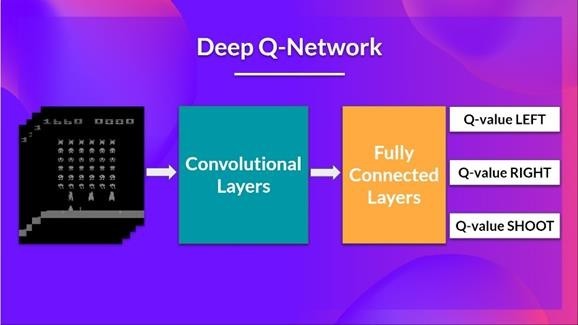

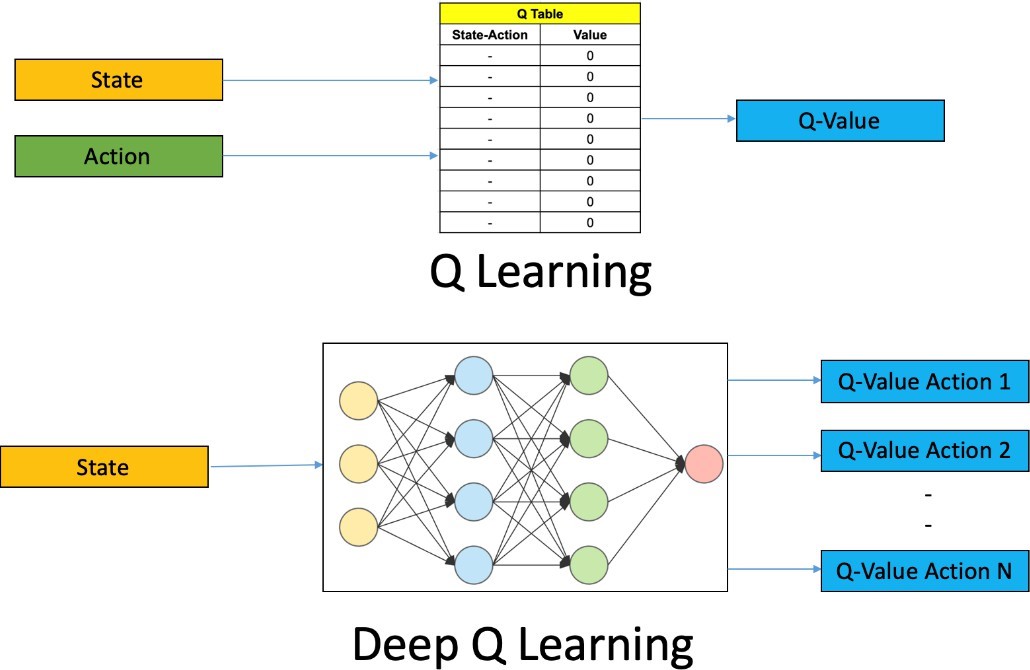

1.3 Q-Learning and Deep Q-Networks (DQN)

Two well-liked RL algorithms for dynamic pricing are Deep Q- Networks (DQN) and Q-learning. A model-free reinforcement learning technique called Q-learning learns to estimate the utility or expected return of an action in a particular condition. DQN is a type of Q- learning in which the Q-function is approximated using a neural network.

Fig 1.3 Deep Q Networks

Agents can learn from their interactions with the environment by using the reinforcement learning technique known as Q-learning. Q- learning optimizes decision-making by updating the action-value function by forecasting the expected return or reward for an action performed in a specific state.

By approximating the action-value function using a deep neural network, Deep Q-Networks (DQN) expand on Q-learning. The agent can make well-informed judgments thanks to this neural network, which uses the state as input and outputs the predicted Q-values for each potential course of action. A neural network, experience replay, target network, and exploration-exploitation trade-off are the main elements of DQN. The agent can successfully learn from its experiences and enhance its decision-making skills by striking a balance between exploration and exploitation. DQN has a number of benefits, such as increased flexibility, scalability, and performance. But there are drawbacks as well, like sample complexity, overestimation, and stability problems.

Fig 1.4 Deep Q Learning

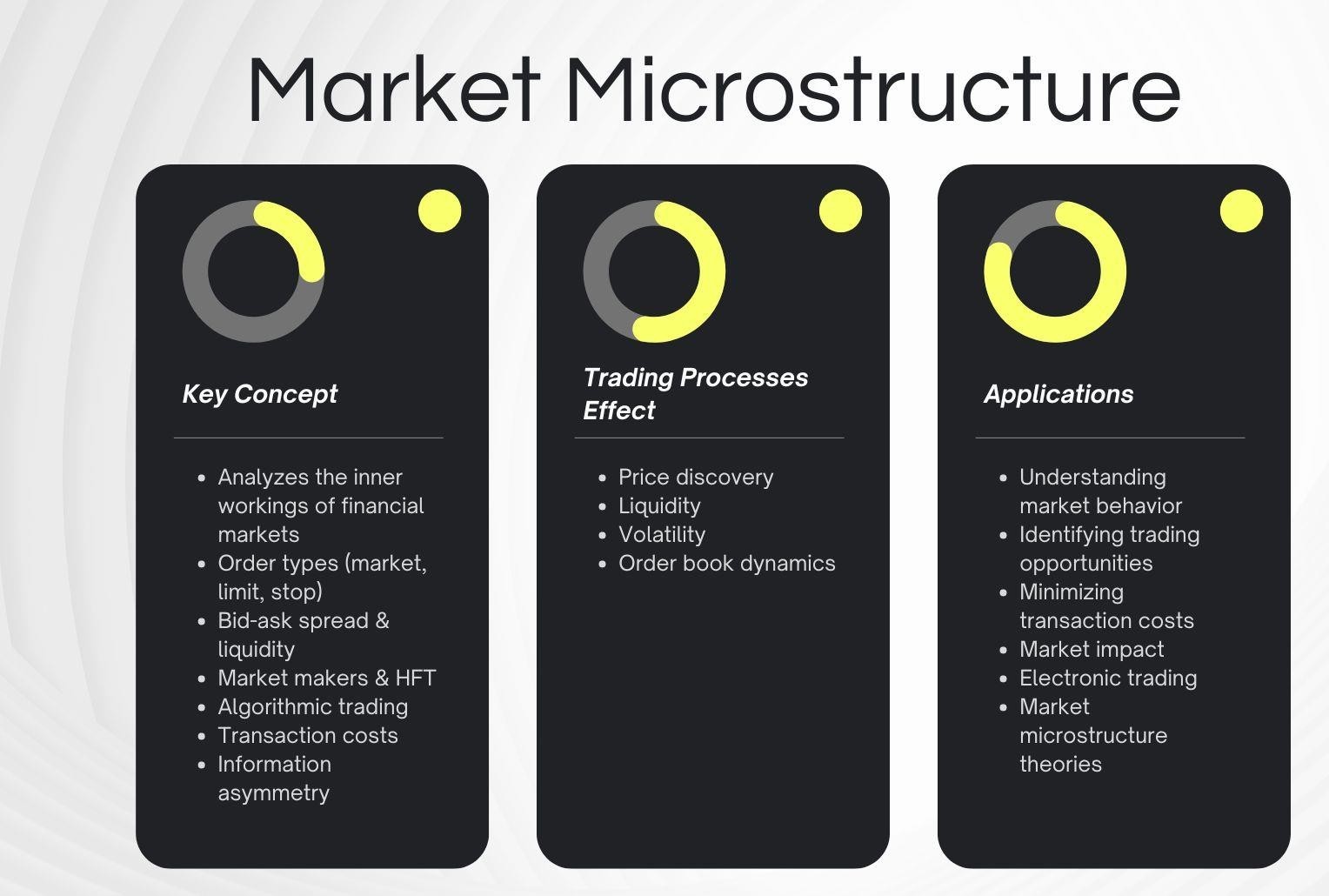

1.4 Market Microstructure Analysis

The study of the procedure and results of asset exchanges conducted under clear regulations is known as market microstructure analysis. It facilitates comprehension of consumer behaviour, market dynamics, and how various pricing methods affect market results. Businesses can make better pricing decisions by gaining important insights into the dynamics influencing supply and demand through the analysis of market microstructure.

Fig 1.5 Market Microstructure

1.5 Real-World Applications

A number of businesses have used RL and Market Microstructure Analysis to successfully deploy dynamic pricing strategies. For instance:

- Uber employs reinforcement learning (RL) to optimize surge pricing in real-time, accounting for supply, demand, and traffic.

- Amazon uses RL to dynamically modify prices in response to inventory levels, customer behaviour, and rival pricing.

- Airlines optimize ticket pricing by considering supply, demand, and rival pricing through the application of Market Microstructure Analysis.

Fig 1.6 Uber uses AI to optimize surge pricing

Fig 1.7 Optimizing Airline Revenue Management and Ticketing with AI

1.6 Benefits and Challenges

Using RL and Market Microstructure Analysis in dynamic pricing techniques has the following advantages:

- Improved revenue and profitability

- Enhanced competitiveness

- Increased efficiency

Adopting these cutting-edge methods does present certain difficulties, though, such as:

- High computational requirements

- Need for large datasets

- Complexity of implementation

Fig 1.8 Increased efficiency

1.7 Future Trends and Advancements

Data science and artificial intelligence advancements are propelling the dynamic pricing field’s rapid evolution. Future developments and trends could include the following:

- Increased use of RL and other AI techniques in dynamic pricing

- Integration of Market Microstructure Analysis with other data sources, such as social media and IoT data

- Development of more sophisticated pricing algorithms that take into account multiple factors.

1.8 Conclusion

To sum up, dynamic pricing strategies that make use of RL and Market Microstructure Analysis provide a potent way to maximize pricing choices in intricate, quickly evolving contexts. Although implementing these cutting-edge strategies might be difficult, the advantages of increased revenue, competitiveness, and efficiency make them a desirable choice for companies looking to stay one step ahead of their rivals.